Strategy

Long-Term Vision

Long-Term Vision 2030 (Fiscal 2021–Fiscal 2030)

A power electronics company which creates environmentally friendly, cutting-edge solutions via innovative technologies, contributes to a sustainable society, and continues to be needed by all stakeholders.

-

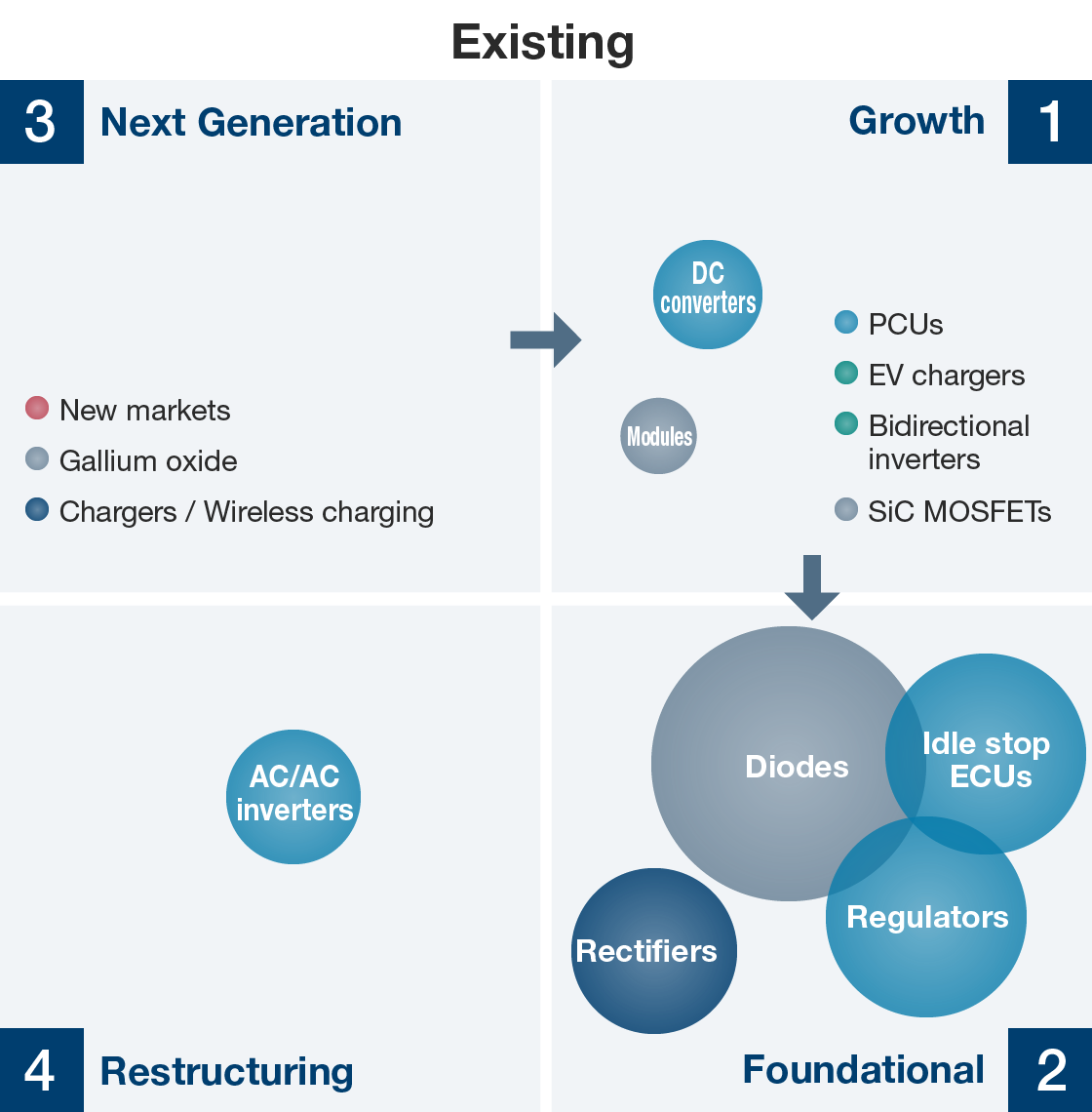

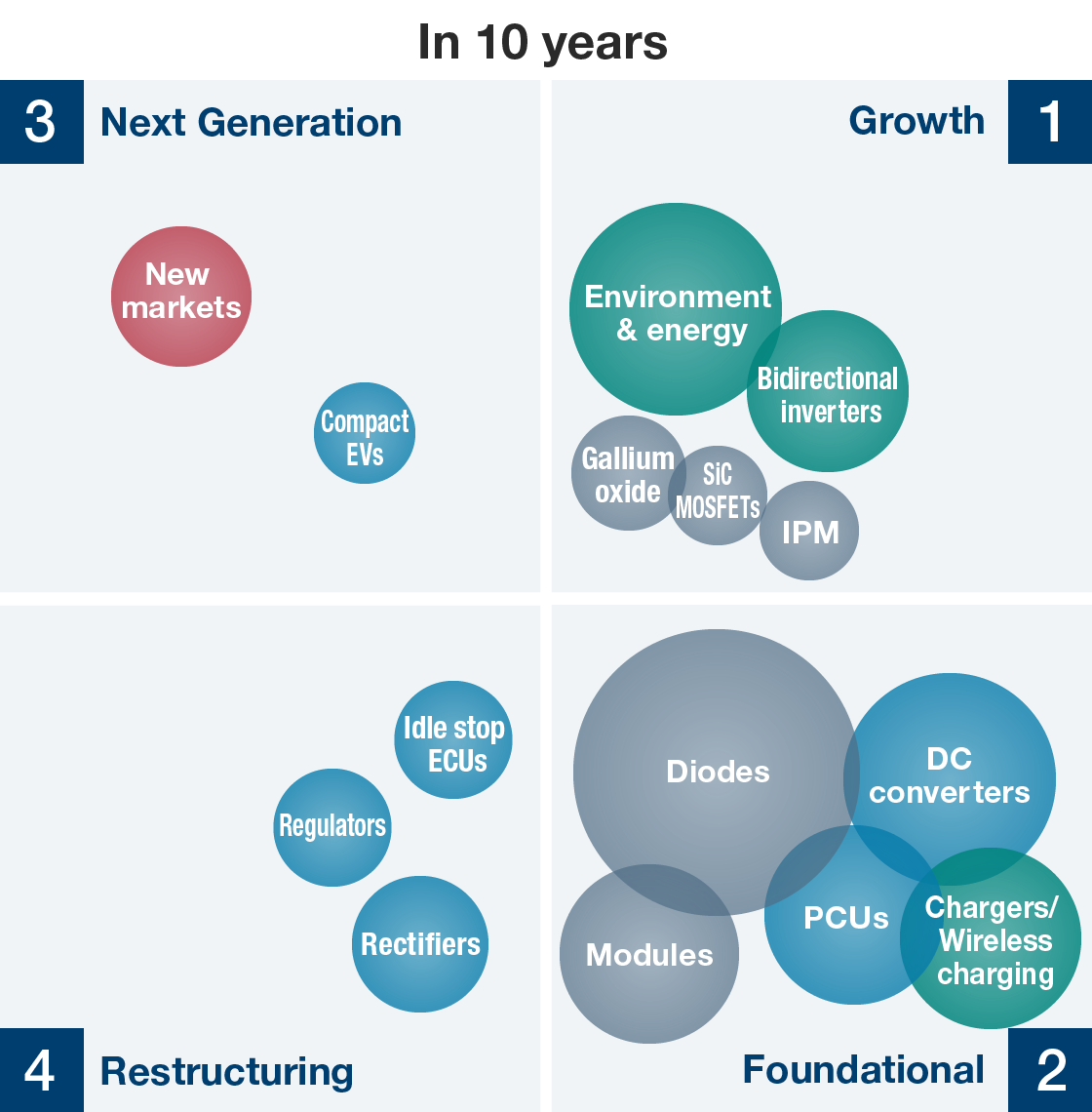

1

Expansion businesses:

Businesses that drive corporate growth. Proactively invest in these businesses and bring value-added products to market.

-

2

Foundational businesses:

Utilize competitive capabilities and track record to secure a competitive edge.

-

3

Next-generation businesses:

Fields that will support Shindengen's business in the future. Invest resources in fields that allow for the application of core technologies.

-

4

Restructuring businesses:

Analyze future trends and revise allocation of resources.

16th Medium Term Business Plan (Fiscal 2022–Fiscal 2024)

Management policy

Build a foundation aimed at the realization of Long-Term Vision 2030

Key Themes

-

1

Earnings structure construction (construct systems for affordable manufacturing)

-

2

Building a foundation for expansion of growth businesses (development of unique and appealing products, increase speed of market introduction)

-

3

Focusing resources on product groups that can reduce greenhouse gas emissions

We will broadly utilize digital transformation (DX) in the implementation of measures to realize the management policy.

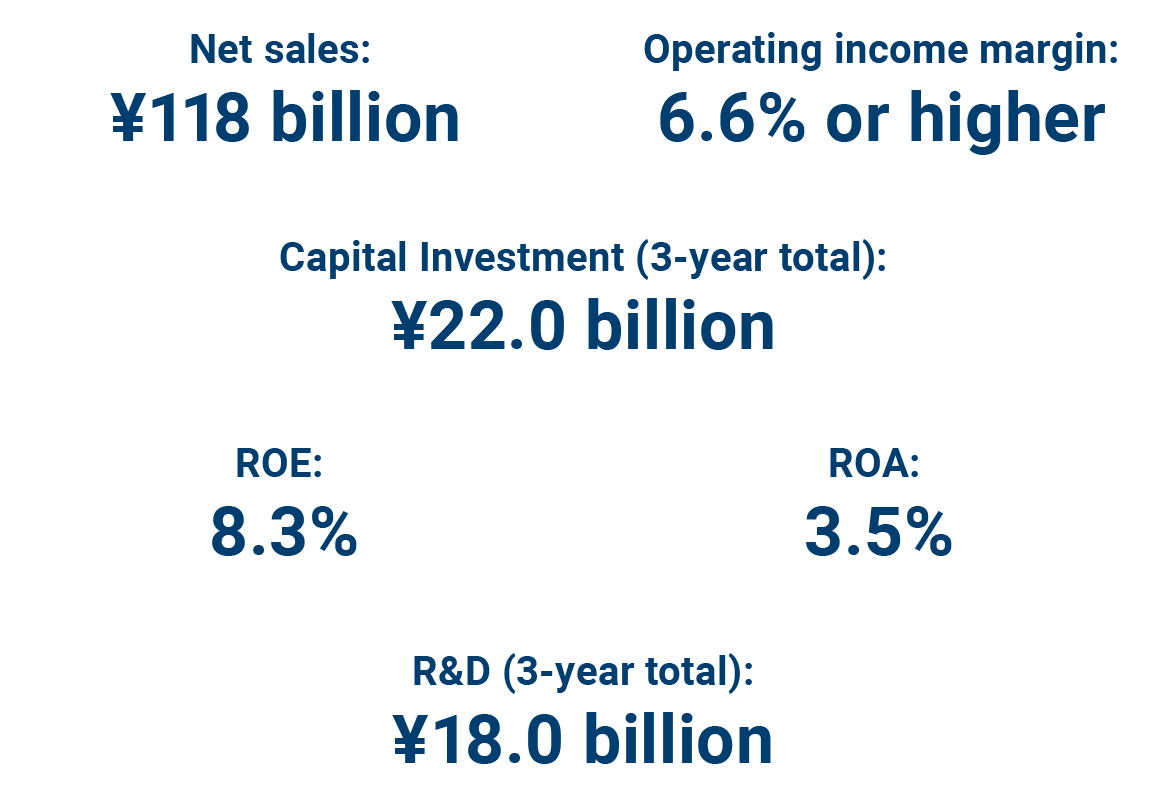

Targets for Fiscal 2024

Progress and Issues

In fiscal 2023, based on the three key themes of the Medium Term Business Plan's management policy, we launched a new power semiconductor that reduces power consumption, started mass production of power control units (PCU) for motorcycle EVs in India, announced the new MITUS series brand of EV chargers, and began sales of concealed AC chargers. In addition, we continued various measures to enhance corporate value and realize a sustainable society, including the establishment of a sustainability promotion system to advance ESG management and the development of initiatives in line with our basic policy.

On the other hand, due to the significant decrease in device demand (mainly caused by the sluggish economy in China), as well as soaring raw material and energy costs, our previously released fiscal 2024 management targets for net sales, operating income margin, ROE, and ROA are no longer realistic. The management targets for fiscal 2024 have been revised as follows.

Management Targets for Fiscal Year 2024 (Consolidated)

In fiscal 2024, the final year of the 16th Medium Term Business Plan, the Company will optimize its business portfolio to realize Long-Term Vision 2030. In the Electronic Device segment in particular, the Company will position the mobility area, which is expected to grow, as a priority market and will expand sales. In order to rebuild our earnings platform, we will optimize production, logistics, and sales layouts; review sales prices to reflect rising costs; and promote cost reduction activities. In pursuit of business and technological opportunities, we will also concentrate management resources in areas and regions with growth potential. In particular, with India as our main target, our local subsidiary, Shindengen India Private Limited, will focus on improving productivity and bolstering sales activities, as well as developing products by creating business synergies and producing and selling products that meet the needs of the market. By steadily implementing these and other initiatives, the Company will advance toward its 17th Medium Term Business Plan, which will be launched in fiscal 2025.

The Evolution of Shindengen’s Medium Term Business Plans

-

14th Medium Term Business Plan

(Fiscal 2016–Fiscal 2018)

Management policy

“Working toward technological superiority,” “speed” and “expanding overseas sales”

Purpose of the plan

Building the foundations for growth to reach the goals for fiscal 2021

Business Policies

-

1

Technological development

- Promote synergies centered on semiconductors

- Shorten development times

- Improve product quality

-

2

Strengthening overseas businesses

- Expand sales to non-Japanese customers in Europe, the Americas and Asia

- Promote and strengthen support systems

- Raise the overseas sales ratio

-

3

Promoting business transformation

- Revise existing businesses and products

- Steadily update the product mix

-

4

Driving down production costs

- Invest in labor saving

- Revise procurement methods

-

5

Improving management quality

- Develop globally oriented human resources to expand business in overseas markets

- Utilize ICT / Reinforce the BCP

Results

Achievements:

- Reinforced overseas businesses

- Advanced alliances

Remaining challenges:

- Increasing earnings power

- Speed

-

-

15th Medium Term Business Plan

(Fiscal 2019–Fiscal 2021)

Management policy

Advancing product strategy for sustainable growth

Purpose of the plan

Building the foundations for growth to reach the goals for fiscal 2021

Business Policies

-

1

Enhance the competitiveness of mainstay products

Reinforce earnings power amid intensifying competition with mega-suppliers, local suppliers and new players by pursuing the following:

- Increase productivity

- Overall optimization

- Quality, added value

-

2

Develop growth businesses

- Effectively utilize external resources to make power modules and electric vehicle-related products our next business pillars

- Target the mobility and industrial machinery markets

-

3

Create next-generation products that are a decade ahead

- Move beyond existing business frameworks, possibly utilizing business alliances, to create next-generation products

Results

Achievements:

- Acquired new customers in the Indian motorcycle market

- Increased earnings power through Groupwide business structure reforms

- Secured agreements to supply new products for electrified vehicles

- Released the first high-output EV quick charger from a Japanese manufacturer

- Developed next-generation devices through external alliances

- Developed wireless charging systems

- Established the Future Product Development (FPD) Department

Remaining challenges:

- Further increasing the earnings power of the Electronic Device Business (consolidate clean rooms, increase wafer sizes, etc.)

- Creating high value-added products and reinforcing earnings power in power modules

- Commencing mass production of next-generation devices and expanding lineup of compatible products

- Utilizing external resources to accelerate development

-