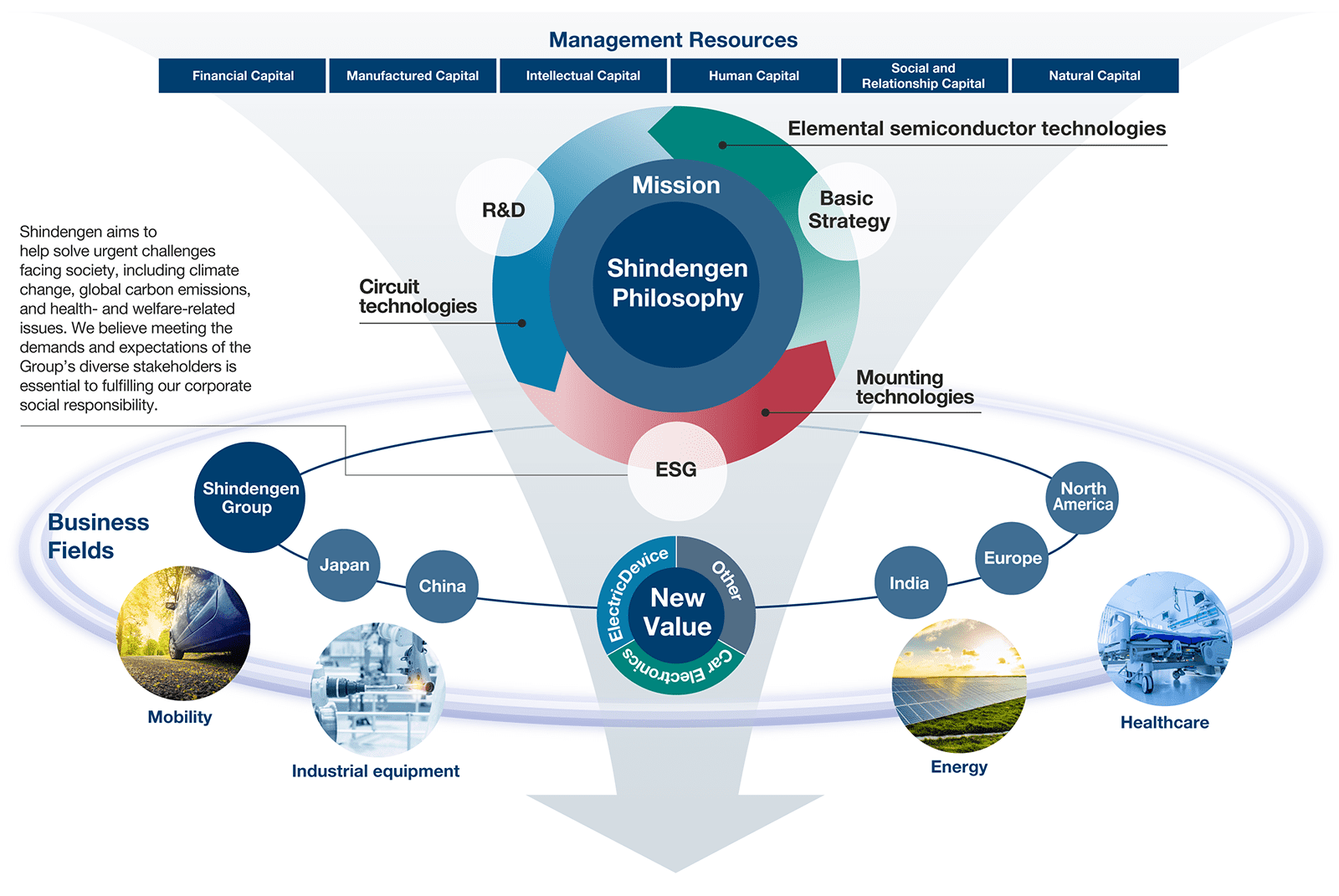

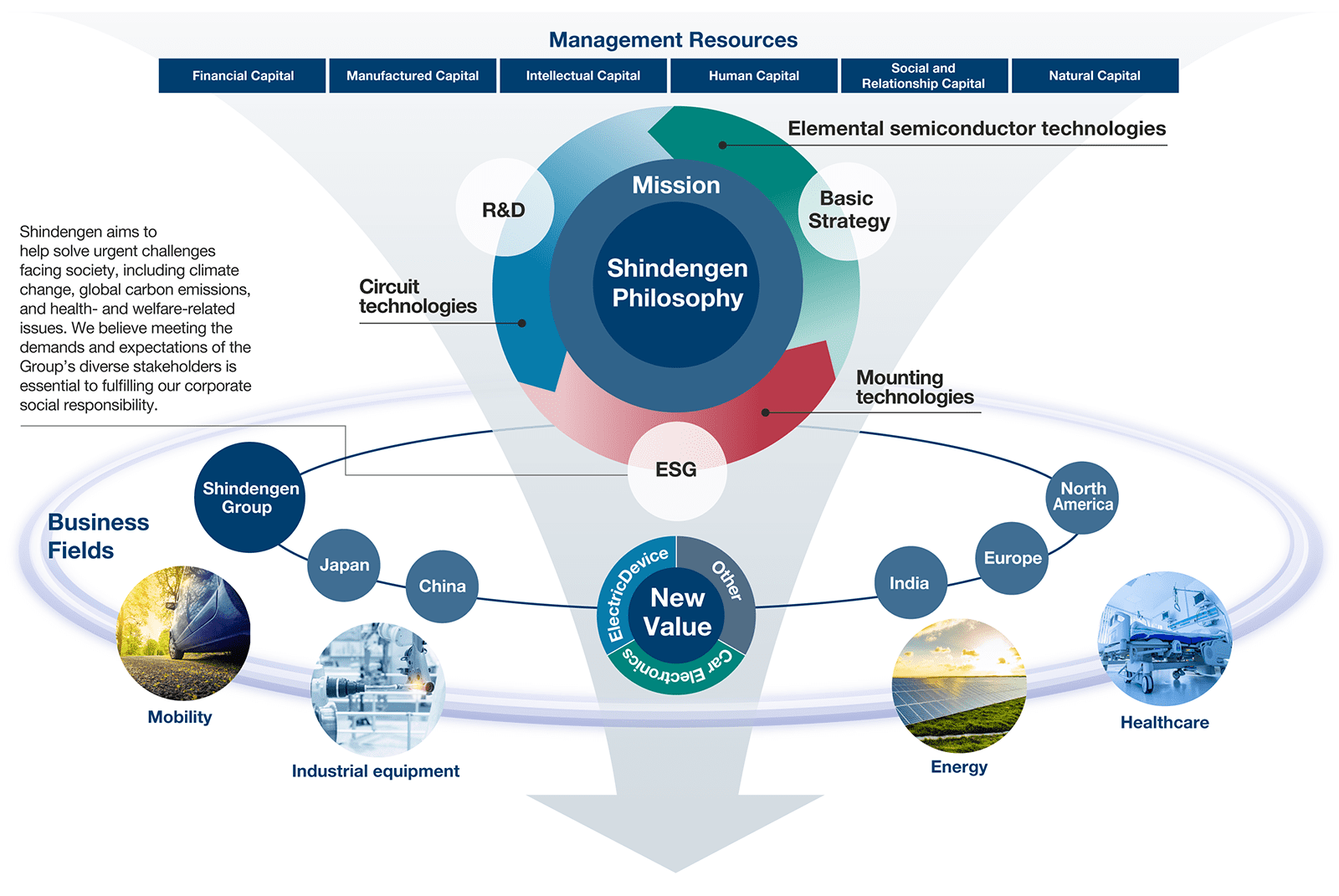

Who We Are

Value Creation Model

Input

(As of March 31, 2023)

-

Financial Capital:

- Funding for stable business operations

- Funding for growth

- Equity ratio: 42.4%

- Capital investment: ¥5.3 billion

-

Manufactured Capital:

- Global manufacturing bases, manufacturing facilities

- Manufacturing bases: 11 worldwide (4 domestic, 7 overseas)

-

Intellectual Capital:

- R&D bases

- Semiconductor and electronic part design and manufacturing technologies

- Core technologies maintained since the Company’s founding

- R&D bases: 5 worldwide

- R&D expenses: ¥4.1 billion

-

Human Capital:

- Diverse talent

- Manufacturing expertise

- Mission awareness

- Employees: 5,268 individuals in 15 countries

- Improvement activities

- Human resource development

-

Social and Relationship Capital:

- Robust customer base

- Participating in cutting-edge research

- Countries where we do business: 59

- Product fields: Mobility, consumer electronics, industrial machinery, etc.

-

Natural Capital:

- Electricity and water needed for business activities

- Annual energy use: 142,287 MWh

(136,116 MWh in the previous fiscal year)

Outputs

-

Electronic Device:

Diodes and other power semiconductors, power modules, etc.

-

Car Electronics:

Electronic parts for motorcycles and automobiles, etc.

Quick chargers for EVs -

Other

Telecommunication power supplies, AC chargers for EVs/PHEVs, etc.

Outcomes

(As of March 31, 2023)

-

Financial Capital:

- Operating cash flows: ¥2.73 billion

- Market capitalization: ¥34.5 billion

-

Manufactured Capital:

- Electronic Device Business sales from diodes: Approx. 80%

- Car Electronics Business sales from motorcycle products: Approx. 80%

-

Intellectual Capital:

- Electronic Device Business sales from new products: 23%

- Patent applications: 117

-

Human Capital:

- Flex time system usage: 100%

- Female employees: 10%

-

Social and Relationship Capital:

- The Shindengen Group’s material SDGs: 7, 8, 11, 13

-

Natural Capital:

- CO₂ emissions: 78,425 t-CO₂

- Industrial waste emission: 5,682 t